Alibaba Group Holding Limited, commonly referred to as Alibaba, is a Chinese multinational conglomerate specializing in e-commerce, retail, Internet, and technology. Founded in 1999 by Jack Ma, the company has grown exponentially to become one of the world's largest and most influential tech companies. For investors and market enthusiasts, understanding the dynamics of Alibaba Group Holding (BABA) stock is crucial. In this article, we will delve into the overview of Alibaba, its financial performance, and the factors influencing its stock price.

Introduction to Alibaba Group Holding

Alibaba's core business encompasses a wide range of sectors including e-commerce, cloud computing, digital media and entertainment, and innovation initiatives. Its most notable platforms include Alibaba.com, Taobao Marketplace, Tmall, and AliExpress, which have revolutionized the way people shop and conduct business in China and beyond. The company's mission to make it easy to do business anywhere has resonated globally, making it a household name.

Financial Performance and Growth

Alibaba's financial performance has been impressive, with steady growth in revenue and net income over the years. The company's diversification strategy, coupled with its innovative approach to e-commerce and technology, has enabled it to maintain a competitive edge. Key areas such as cloud computing, through its Alibaba Cloud subsidiary, have shown significant potential for future growth, offering a range of services including data storage, networking solutions, and big data analytics.

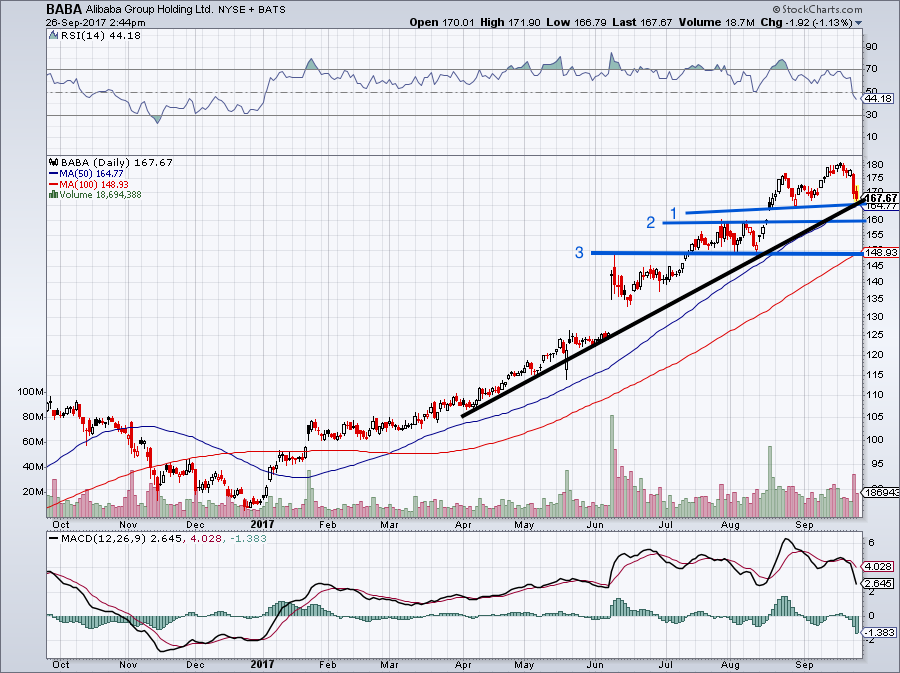

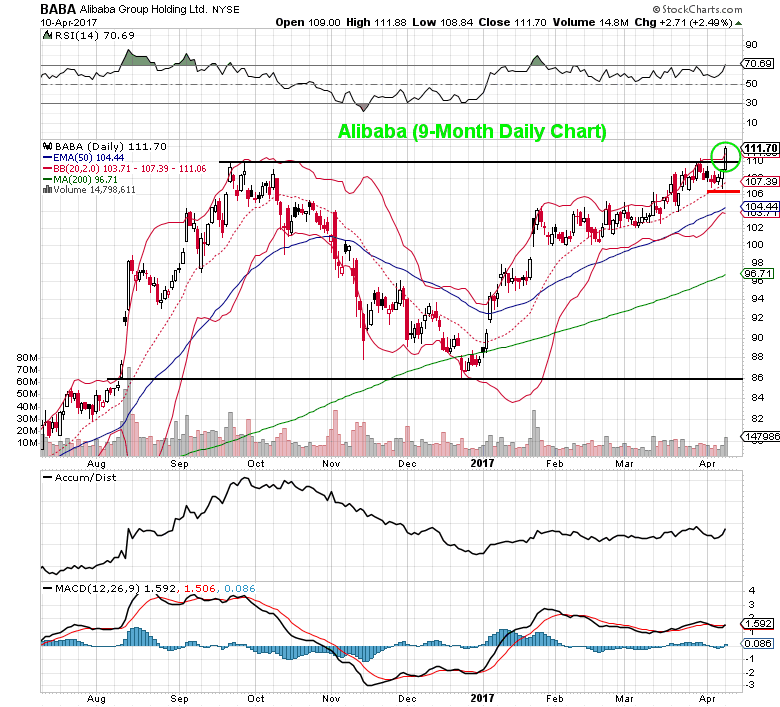

BABA Stock Performance

The stock price of Alibaba Group Holding (BABA) has been subject to various market and economic factors since its initial public offering (IPO) in 2014, which was the largest IPO in history at the time. Listed on the New York Stock Exchange (NYSE), BABA stock has experienced fluctuations, influenced by factors such as regulatory changes in China, global economic trends, and the company's expansion into new markets and sectors. Despite these challenges, Alibaba has demonstrated resilience and adaptability, with its stock remaining a significant player in the tech industry.

Factors Influencing BABA Stock Price

Several factors contribute to the volatility and potential of BABA stock:

-

Regulatory Environment: Changes in Chinese regulatory policies, especially those affecting the tech and e-commerce sectors, can significantly impact Alibaba's operations and stock performance.

-

Global Expansion: Alibaba's efforts to expand into international markets can influence its stock, with successes and challenges in these endeavors affecting investor confidence.

-

Competition: The competitive landscape of the tech and e-commerce industries, both in China and globally, plays a crucial role in Alibaba's growth and stock price.

-

Innovation and Diversification: The company's ability to innovate and diversify its services, such as advancements in cloud computing and fintech, can drive growth and impact the stock price.

Alibaba Group Holding (BABA) stock represents a compelling opportunity for investors looking to tap into the growth of the global e-commerce and tech sectors. With its strong foundation in China and expanding presence worldwide, Alibaba is poised for continued growth. Understanding the factors that influence BABA stock price and keeping abreast of the company's strategic moves and industry trends are essential for making informed investment decisions. As the global economy continues to evolve, Alibaba's adaptability, innovation, and commitment to its mission will be key to its success and the performance of its stock.

For those interested in the tech and e-commerce spaces, following Alibaba's journey and the dynamics of BABA stock can provide valuable insights into the future of global commerce and technology. Whether you're a seasoned investor or just starting to explore the market, Alibaba Group Holding offers a fascinating case study of innovation, resilience, and global impact.