As investors navigate the complex world of finance, it's essential to stay informed about the various tools and instruments available to help achieve their goals. One such instrument is the iShares 20+ Year Treasury Bond ETF, commonly referred to by its ticker symbol TLT. In this article, we'll delve into the TLT stock chart, exploring its significance, how it works, and what it can reveal about the market.

What is the TLT Stock Chart?

The TLT stock chart represents the performance of the iShares 20+ Year Treasury Bond ETF, an exchange-traded fund (ETF) that tracks the investment results of an index composed of U.S. Treasury bonds with remaining maturities of 20 years or more. This ETF is designed to provide investors with exposure to long-term Treasury bonds, offering a way to diversify their portfolios and potentially generate regular income.

How Does the TLT Stock Chart Work?

The TLT stock chart is a graphical representation of the ETF's price movements over time. It plots the fund's net asset value (NAV) or market price against a specific timeframe, which can range from minutes to years. By analyzing the TLT stock chart, investors can identify trends, patterns, and potential trading opportunities. The chart can also provide insights into the overall health of the bond market and the broader economy.

Key Components of the TLT Stock Chart

When examining the TLT stock chart, there are several key components to focus on:

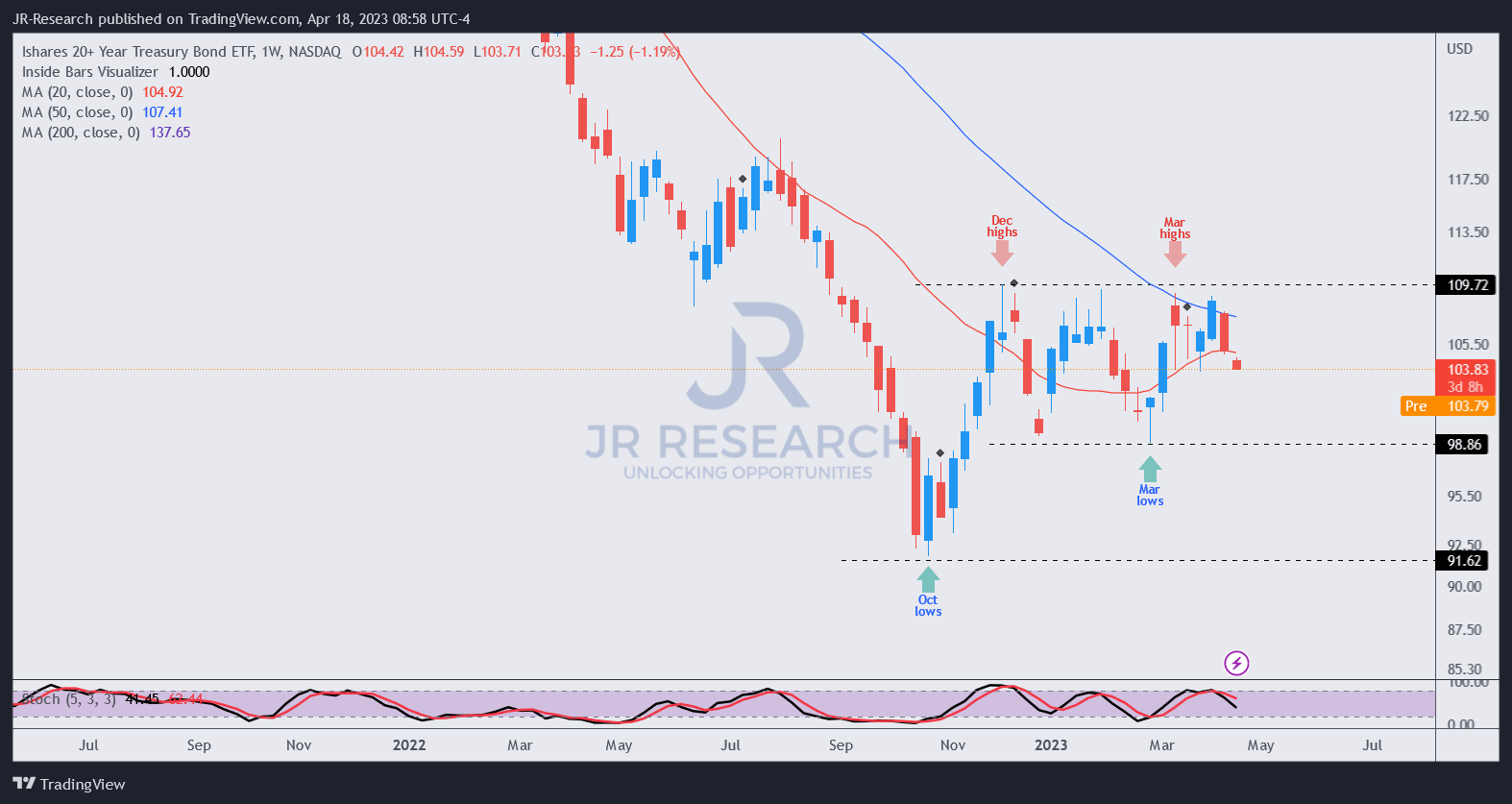

Price: The current market price of the ETF, which reflects the value of the underlying Treasury bonds.

Volume: The number of shares traded, which can indicate market interest and liquidity.

Moving Averages: Lines that smooth out price fluctuations, helping to identify trends and patterns.

Relative Strength Index (RSI): A momentum indicator that measures the speed and change of price movements.

What Can the TLT Stock Chart Reveal?

By analyzing the TLT stock chart, investors can gain valuable insights into the market, including:

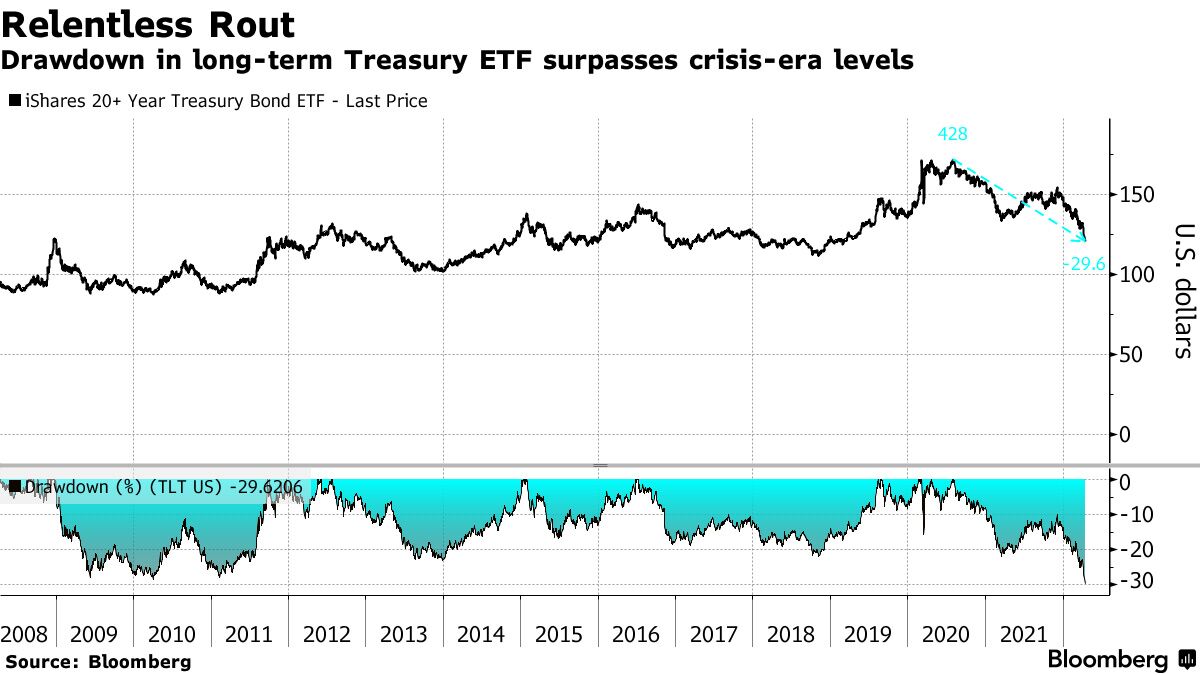

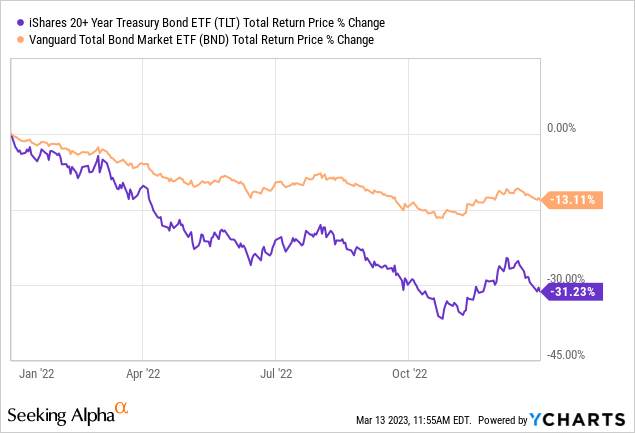

Interest Rate Trends: Changes in the TLT stock chart can indicate shifts in interest rates, which can impact the overall economy.

Inflation Expectations: The chart can provide clues about inflation expectations, as Treasury bond yields are often seen as a proxy for inflation.

Market Sentiment: The TLT stock chart can reflect investor sentiment, with rising prices indicating bullish sentiment and falling prices indicating bearish sentiment.

The TLT stock chart is a powerful tool for investors looking to navigate the world of long-term Treasury bonds. By understanding the components of the chart and analyzing its trends and patterns, investors can make more informed decisions about their investment portfolios. Whether you're a seasoned investor or just starting out, the TLT stock chart is an essential resource to add to your toolkit. With its insights into interest rates, inflation expectations, and market sentiment, the TLT stock chart can help you unlock the potential of long-term Treasury bonds and achieve your investment goals.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.