Introduction to IRMAA Brackets

-----------------------------

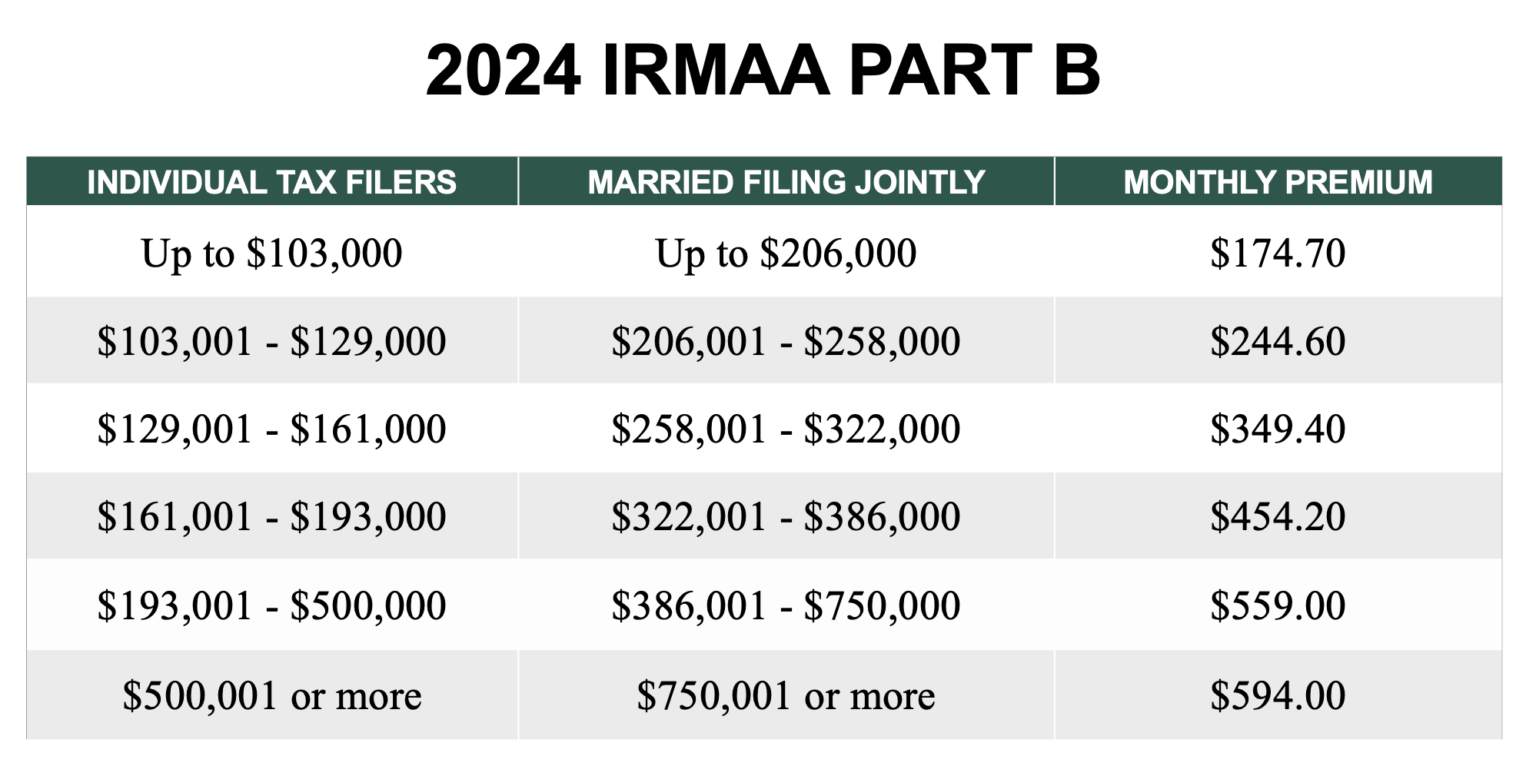

The Income-Related Monthly Adjustment Amount (IRMAA) is an additional premium that some Medicare beneficiaries pay for their Medicare Part B and Part D coverage. The IRMAA brackets, also known as the sliding scale tables, determine the amount of this additional premium based on an individual's income level. In this article, we will delve into the world of IRMAA brackets and explore how they work, including the latest updates and changes.

How IRMAA Brackets Work

------------------------

The IRMAA brackets are based on an individual's Modified Adjusted Gross Income (MAGI), which includes their taxable income, as well as tax-exempt interest and certain other types of income. The brackets are adjusted annually for inflation, and the premium amounts are based on a sliding scale. The higher an individual's income, the higher their IRMAA premium will be.

The IRMAA brackets are divided into several tiers, with each tier corresponding to a specific income range. For example, in 2022, the IRMAA brackets for Medicare Part B are as follows:

Tier 1: $91,000 or less (single) / $182,000 or less (joint)

Tier 2: $91,001 - $114,000 (single) / $182,001 - $228,000 (joint)

Tier 3: $114,001 - $142,000 (single) / $228,001 - $284,000 (joint)

Tier 4: $142,001 - $170,000 (single) / $284,001 - $340,000 (joint)

Tier 5: $170,001 - $214,000 (single) / $340,001 - $428,000 (joint)

Tier 6: $214,001 or more (single) / $428,001 or more (joint)

IRMAA Sliding Scale Tables

---------------------------

The IRMAA sliding scale tables provide a detailed breakdown of the premium amounts for each tier. The tables are updated annually to reflect changes in the cost-of-living adjustment (COLA) and other factors. For example, the 2022 IRMAA sliding scale table for Medicare Part B is as follows:

| Tier | Single | Joint | Medicare Part B Premium |

| ---- | ------ | ---- | ------------------------ |

| 1 | ≤$91,000 | ≤$182,000 | $148.50 |

| 2 | $91,001-$114,000 | $182,001-$228,000 | $207.90 |

| 3 | $114,001-$142,000 | $228,001-$284,000 | $297.00 |

| 4 | $142,001-$170,000 | $284,001-$340,000 | $386.10 |

| 5 | $170,001-$214,000 | $340,001-$428,000 | $475.20 |

| 6 | ≥$214,001 | ≥$428,001 | $504.90 |

Conclusion

----------

In conclusion, understanding IRMAA brackets and sliding scale tables is crucial for Medicare beneficiaries who want to plan their healthcare expenses effectively. By knowing how the IRMAA brackets work and how they impact Medicare premiums, individuals can make informed decisions about their healthcare coverage. At Binfy, we are committed to providing our clients with the latest information and updates on IRMAA brackets and sliding scale tables, ensuring that they are always ahead of the curve when it comes to their Medicare coverage.

If you have any questions or concerns about IRMAA brackets or sliding scale tables, our team of experts is here to help. Contact us today to learn more about how we can assist you in navigating the complex world of Medicare.