The Goldman Sachs Group, Inc., commonly known as Goldman Sachs, is one of the most renowned investment banking and financial services companies in the world. With a rich history dating back to 1869, the firm has established itself as a leader in the financial industry, providing a wide range of services including investment banking, securities, and asset management. In this article, we will delve into the world of GS stock, exploring its current price, historical trends, and key factors that influence its performance.

GS Stock Price: Current Trends and Historical Overview

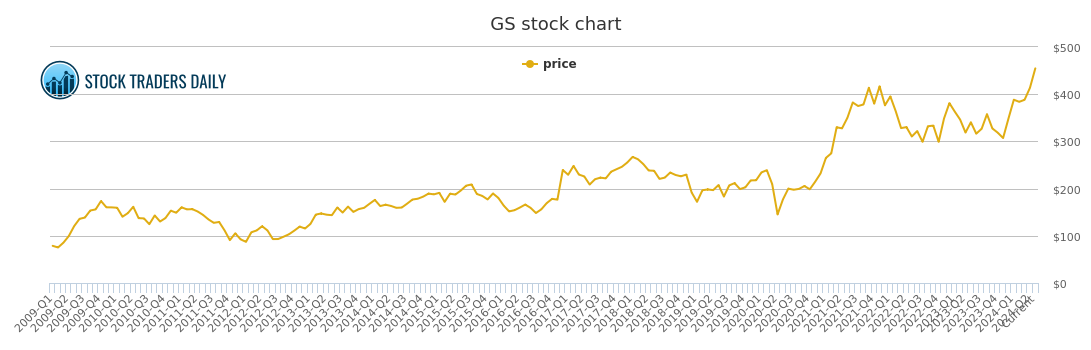

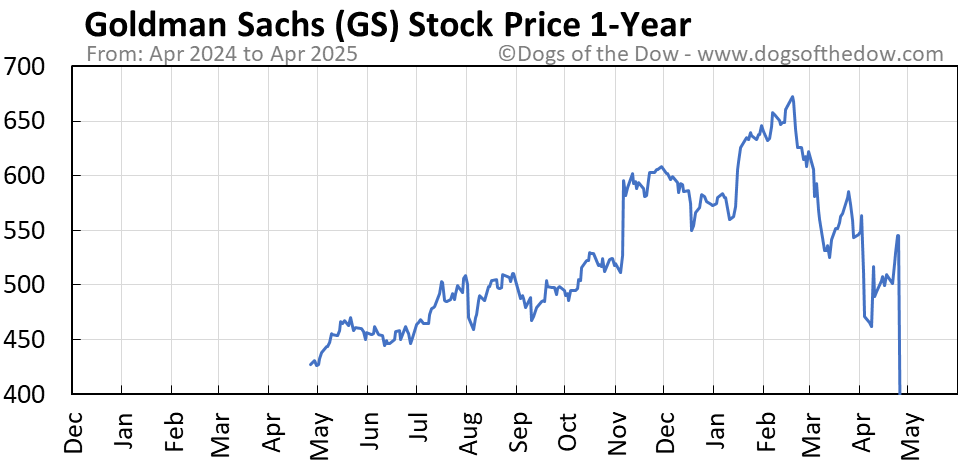

As of the latest market update, the GS stock price is trading at around $340 per share. Over the past year, the stock has experienced significant fluctuations, with a 52-week high of $383 and a 52-week low of $250. The current price represents a moderate increase from its 5-year low, indicating a steady recovery from the COVID-19 pandemic-induced market downturn.

Historically, GS stock has demonstrated a strong track record of growth, with an average annual return of around 10% over the past decade. However, the stock's performance is closely tied to the overall health of the global economy, and market volatility can significantly impact its price.

Key Factors Influencing GS Stock Price

Several factors contribute to the fluctuations in GS stock price, including:

Global Economic Trends: As a global investment bank, Goldman Sachs is heavily influenced by macroeconomic factors such as GDP growth, inflation, and interest rates. A strong economy tends to boost the stock's price, while economic downturns can lead to declines.

Regulatory Environment: Changes in regulatory policies, particularly in the financial sector, can significantly impact GS stock. Stricter regulations can increase costs and reduce profitability, while deregulation can lead to increased revenue and growth opportunities.

Competition and Market Share: The investment banking industry is highly competitive, and Goldman Sachs faces intense competition from other major players such as Morgan Stanley and JPMorgan Chase. The firm's ability to maintain its market share and expand its services can positively impact its stock price.

Earnings and Revenue Growth: GS stock price is closely tied to the company's financial performance, including its earnings and revenue growth. Strong quarterly results can lead to increased investor confidence and a higher stock price.

Investing in GS Stock: Is it a Good Choice?

With its rich history, diverse services, and strong brand reputation, GS stock can be an attractive option for investors seeking exposure to the financial sector. However, as with any investment, it's essential to carefully consider the potential risks and rewards.

Pros:

Established Brand: Goldman Sachs is a well-established and respected brand, with a strong reputation in the financial industry.

Diversified Services: The firm offers a wide range of services, reducing its dependence on any one particular segment.

Experienced Management: Goldman Sachs is led by a seasoned management team with a proven track record of success.

Cons:

Market Volatility: GS stock price can be heavily influenced by market fluctuations, making it a potentially volatile investment.

Regulatory Risks: Changes in regulatory policies can negatively impact the firm's profitability and stock price.

Competition: The investment banking industry is highly competitive, and Goldman Sachs faces intense competition from other major players.

In conclusion, GS stock can be a solid addition to a diversified investment portfolio, offering exposure to the financial sector and potential long-term growth. However, it's essential to carefully consider the potential risks and rewards, staying informed about market trends, regulatory changes, and the company's financial performance. By doing so, investors can make informed decisions and navigate the complexities of the GS stock price with confidence.